The best Indicator-Based algo trading strategy to trigger a buy or sell signal. This Indicator is used to build algorithms to execute trades when market conditions are met. The best indicator measures the price, volume, and other statistics in the market. In this post, we have explained different Indicators that are used depending on data-driven signals. These indicators enable you to automate your trading strategies to minimize efforts and facilitate better execution. Read on to learn about the top five Indicator-based algo trading strategies in 2025.

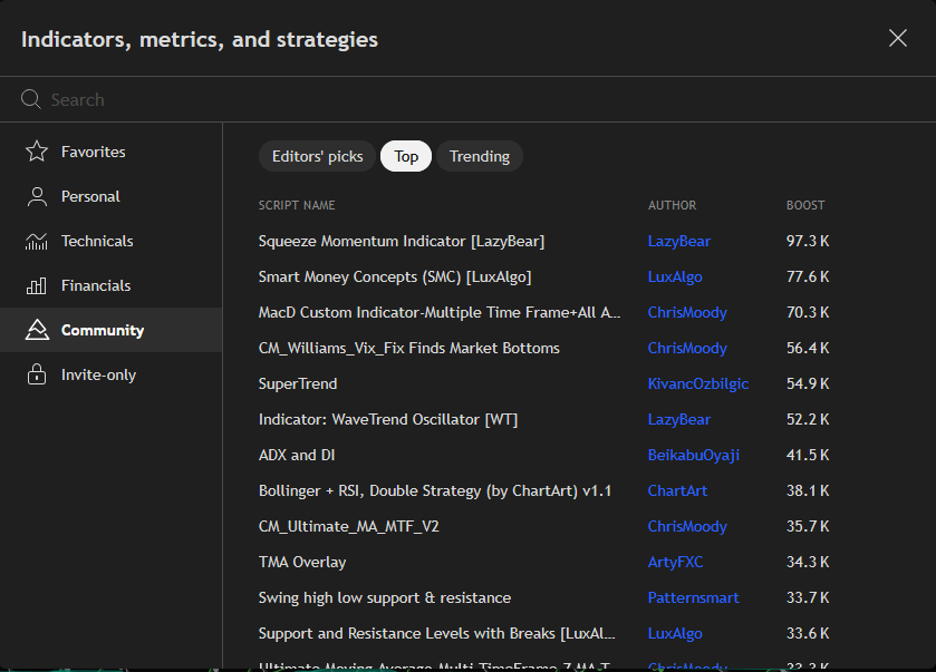

Smart Money Concepts (SMC)

The smart money algo is one of the most popular tools available on the TV platform. Consider this your all-in-one tool that focuses on price action based on market structure. Find significant levels for market structure, breaks of market structure, and change in market character. These levels reveal where the “smart money” or high volume traders are active. Assess your trades based on fair value gaps, liquidity zones, and optimal entry/exit points. Additionally, the LuxAlgo brand is one of the top providers of community tools and strategies. As you can see in the image above, the SMC script has 77K boost. It’s tested by thousands of traders worldwide. You can also get free 30-day access to Luxalgo trade reversal tools.

Average True Range (ATR) Measurement

Add the ATR to your charts to measure the range between previous periods, indicating the volatility of the asset. Check the ATR to understand how much price is fluctuating over the last 14 periods by default. However, you can adjust the look back window to shorter periods, especially for shorter time frames. You can test out the following setting with your 1-minute scalping algo strategy:

- ATR period length: 10, 14, 21, 30 periods

- ATR Stop-Loss: 1X, 2X, 3X, 5X multipliers

Many day traders use this information to set stop loss levels to avoid getting their positions taken out. Other traders identify volatility in the market to confirm signals or filter trades with their overall strategy. Adjust your positions in live time by adjusting to market volatility and protecting your capital when conditions change.

Candle Timer Indicator

The Candle Timer Indicator is one of the top 5 algos for automated strategy in 2025. With this indicator, monitor an specific candle in the candlestick chart to discover when the supervised candle will close and a new one will open. As soon as you activate it, a countdown timer displays with the exact period of time left— in minutes and seconds —before a new candle starts. You can utilize the Candle Timer tool for short-term trading to open or close positions right in time. To get an accurate price moment prediction, you can combine this algorithm with others — like the Bollinger Bands — to increase your profitable chances. For added profitability and security, choose SEC approved brokers for US traders. Surely, leverage the top-5-reated Candle Timer Indicator for a better algo-trading strategy in 2025.

Auto TrendLine Indicator

Auto trend line indicator is the most considerable instrument for algo trading in 2025. Rather than manually creating multiple trend lines all over the chart, the Auto trend indicator displays only the most accurate trend lines. Each trend line comprises multiple components, such as:

- Blue dash lines

- Pivot points

- Orange/purple lines

- Circles in green/red color.

You can also tweak the indicator’s Algo to create a strategy, as auto trend line indicator uses swing detection codes to form trend lines. Just ensure these techniques are supported by your TradingView broker. You can take continuation trades on the price bouncing off the trend line or reversals from a trend line breakout. Also, checkout TradingView Algo indicators that are compatible with Metatrader 4 & 5.

Try auto trend line indicator to save time and emotional burden on your next algo trading strategy in 2025.

Risk Reward Indicator

Use the risk-reward indicator in your algo trading strategy in 2025. You need to manage risk to become successful in trading. The best way to manage this is to calculate the Risk-to-reward Ratio (RRR). You can combine this tool with your trading strategy to trade forex. The RR Indicator calculates risk, which is the difference between entry and stop loss in trade. The Risk Reward tool allows you to analyze –

- Risk involved in the trade.

- Entry and exit prices for the trade.

- Reward with the trade.

- If the trade is open based on the target and stop-loss prices.

You can use this indicator to differentiate between good and bad trades. The good trades have the Risk to Reward ratio of 1:2. Whereas the bad trades have the Risk to Reward value of less than 1:2. Before implementing this indicator, ensure it aligns with broker requirements & your current experience level. You can additionally verify if services like Interactive Brokers are good for beginners. Surely use the Risk Reward Indicator in your trading strategy in 2025.

Show Pips Indicator

Leverage Show pips indicator to build an algo trading strategy in 2025. Show pip indicator gives you an insight into your current open position by displaying profit/loss in different forms such as pips, percentages, or in monetary values for the current symbol. Beside the margin display, the Show pip indicator even shows the spread in each symbol, which are crucial in risk management at the time of high impact news. Show pip tool presents all the stats of your current position on the top right corner of your MT5. Show pip tool is free and easy to install. Create a precise based trading strategy using real-time analysis in 2025.

Quantum Algo Trading EA MT4

Choose the best quantum algo trading EA MT4 strategy in 2025. The Quantum algo trading EA MT4 is a cutting-edge solution to scale your trading strategies. You can use the quantum advanced algo trading model to optimize your trade for profitability. The EA analyses the market using its multi-layered algorithm to identify potential trades. The indicator examines price patterns, market volatility, and trend directions to determine entry and exit points. Review key features of quantum EA –

- Advanced breakout system to optimize an algorithm for market breakouts.

- Realistic back testing for accurate results

- Forward testing validation which is 99.9% similar to backtest data

- News filter to avoid high-impact news volatility.

- Buy-only or sell-only modes.

You can automate your strategies using this and execute trades with precision. Plus, leverage algo trading software to maximize efficiency, accuracy, and results. Surely, start using quantum algo trading EA MT4 strategy in 2025.

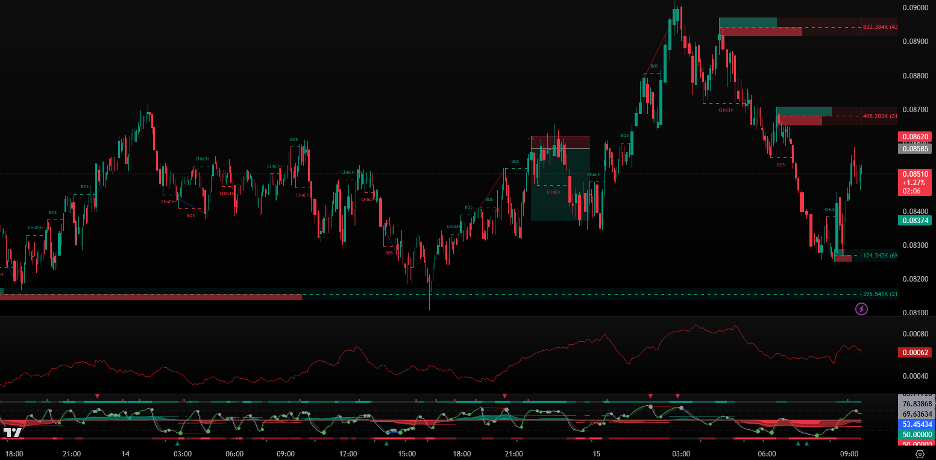

FVG Trailing Stop Indicator

Use the FVG trailing stop indicator for your algo trading strategy. The tool allows you to track unmitigated Fair Value Gaps (FVG). The data helps to identify if the market is uptrending or downtrending. You can leverage the FVG Trailing Stop tool to find trend directions in relation to closing price. Check out the important settings to consider while using this tool in your strategy:

- Smoothing length: You can control the trailing stop smoothing length to reduce noise.

- Reset on cross: Hides and resets the trailing stop until the price starts moving in trend direction.

- Unmitigated FVG lookback: This denotes the maximum number of unmitigated FVGs used by the script.

Surely, leverage the FVG trailing stop tool-based trading strategy.

Internal Candle Strength

Choose the internal candle strength tool in your algorithmic trading strategy. The indicator allows you to uncover hidden strengths and weaknesses in a candlestick. The tool divides each candlestick bar into multiple rows. You can get deep market insights by analysing trends on a lower timeframe for each bar. Review the important tool settings for your strategy:

- Timeframe: Set a lower timeframe to extract internal trend data

- Row size: Set each row’s vertical space as a fraction of the total candle range.

You can modify the tool settings to adapt to your trading strategy or market conditions. Surely use the internal candle strength tool in your breakout trading algo strategies in 2025

Liquidity Sweeps

Detect rapid movements & trends with indicator-driven liquidity sweeps. Capitalize on real-time trends & patterns through profitable liquidity zones. Acting fast, you can identify where order clusters and stop losses are getting absorbed. Implement proactive warning alerts that keep you informed with possible market breakouts or reversal opportunities. With these in-place, you can dynamically measure & forecast market behaviors during volatile periods. Accurately identify rapid liquidity, potential clusters, and market exhaustion with powerful sweep tool.

The Echo Forecast

Leverage the echo indicator to strengthen forecasting across your trading strategy. Use the echo forecast to analyze patterns between recent & historical prices. Generate insights & predictions on future prices by learning from recent trends or variations. To measure potential similarities, the tool uses the correlation coefficient for time series forecasting.

Before implementing the echo forecast for real-world activities, make sure you configure the following settings:

- Evaluation Window Size

- Forecasting Window Horizon

- Similar Or Dissimilar Forecast Mode

- Forecast Construction Method

- Required Source Input

Upgrade your tool-based trading strategy with the machine learning trading strategy.