Read an Interactive Brokers vs Oanda 2024 comparison to discover which is better for traders. Known for its competitive core trading environments,IBKR ranks among the best international brokers.

In addition, many traders use Oanda to trade Forex – specifically in the North American market. As a trader getting started, compare Interactive Brokers vs Robinhood with Oanda to decide which platform can better suit your trading needs, strategies, and budget. This way, you can choose the best platform to boost your returns. Keep reading to discover the comparison among both brokerages in 2025.

Spreads & Fees

First, compare IBKR vs Oanda vs IG Markets spreads and fees to choose the best brokerage. For example, both offer $0 maintenance, account, and deposit fees. In addition, Oanda typically charges an inactivity fee of about $10 per month.

With IB, access an average spread of 0.1 pips on EUR/USD with a standard forex account. Similarly, the average spread costs on Oanda ranges from about 1.0 to 1.2 pips. Of course, the company’s stock platform also has a tiered fee structure depending if you’re on IBKR Lite or Pro. In short, compare e*Trade vs IBKR vs Oanda before you choose your brokerage.

Between the two well-known US brokers, the fee structure is quite different.

On OANDA.COM, the online platform has low fees based on spreads. Spreads include the fees, commissions, and costs associated with the transaction. These costs range depending on the instrument or pair. Here’s some examples:

- FX Fees: Spreads range from 1.4 (AUD/USD) to 3.1 (GBP/JPY)

- US Stocks: Not Offered To US Clients

- Cryptocurrencies: Charged by third party at 0.25% of each order.

In comparison, the IBKR fees are not based on spreads. The company stands out from many industry providers that mark up quotes (adding a spread). Instead, IBKR shows the quoted forex price accurately to the smallest 0.1 PIP and charges a consistent low commission of 0.2 basis points or minimum $2 per lot (discounted down to $1.00 for Tier IV volume).

Additionally, the commission based pricing offers more competitive pricing on multiple instruments:

- Forex Fees: No spread, flat 0.2 basis points or min $2/lot (volume discounts)

- $0 Commissions On US Stock Trades With IBKR Lite Account

- 0.18% Commission Of Trade Value On Cryptocurrencies With $1.75/order minimum

- $0.65 fees per contract for options trades

- $0.85 costs per contract on futures orders

A key difference in pricing between Oanda’s structure and Interactive Brokers fees pricing, the spreads vs commissions could cost you much more depending on the pair. Additionally, the firm clearly offers a wider range of pricing fees and flexible costs on many more asset classes including stocks, futures, options, bonds, ETFs, metals and more.

Deposits & Withdrawals

Next, compare IB vs Oanda for deposits and withdrawals to select which is best. Notably, IB and Oanda require a $0 minimum deposit. As a result, you can start trading with Oanda for no minimum deposit. Plus, both allow bank transfers on deposits and withdrawals.

Additionally, you can make deposits on Wise and Revolut on both brokerage platforms as well. Meanwhile, Oanda is a PayPal forex broker that also allows more deposit options through credit/debit cards, and other electronic wallets. Definitely, compare the deposit and withdrawal options to choose the best brokerage firm.

Features

Compare additional features that matter to your trading style. For example, you can trade smaller portions with IBKR’s Fractional Shares. With this feature, diversify your portfolio with expensive stocks or smaller investments, without buying/selling whole shares. Plus, IB allows day trading without PDT rule with cash accounts.

IB also supports global execution and cross-time-zone trading across over 30 different countries. Of course, Oanda offers advanced charting and analysis tools to optimize your trade decisions. With Autochartist, you can scan the market for buying and selling opportunities. Economic Calendar also provide key announcements for financial events. In short, compare their features to choose a broker that meets your needs. Moreover, checkout the in-depth review of IBKR forex broker for US traders to get started.

Trading Platforms

Moreover, compare IBKR vs Oanda vs AvaTrade based on their platforms as you decide which broker is right for you. For example, you can download mobile apps for both brokerages. With Oanda, access a full range of Forex pairs on iOS and Android. On the other hand, IBKR Mobile is great to trade stocks, options, futures, and bonds on the go. Notably, both apps also offer advanced web and desktop capabilities.

Trade on over 150 markets across the globe with IBKR Desktop’s Trader Workstation with these verified TradingView forex brokers. Or, leverage charting tools with MetaTrader 4 or TradingView. Plus, use the VWAP Indicator to produce signals based on your algo strategy on MT4. Undoubtedly, compare the brokerage firms 2025 trading platform capabilities to decide which is right for you.

Regulations and Trust

Furthermore, compare regulations and trustworthiness for Oanda vs Interactive Brokers vs NinjaTraders vs Avatrade. Notably, nine highly trusted tier-one regulators have authorized IBKR. Some of these include the Australian Securities & Investment Commission (ASIC), the Canadian Investment Regulatory Organization (CIRO), and the Japanese Financial Services Authority (JFSA).

Similarly, seven tier-one regulators also grant Oanda approval, including the Monetary Authority of Singapore (MAS), ASIC, and the JFSA. Both the Financial Conduct Authority (FCA) and the Commodity Futures Trading Commission (CFTC) authorized both brokers as well. Importantly, a tier-four regulator also backs the firm- carrying more risk. In short, consider researching regulations and trust before you choose your broker.

Forex Trading Apps

Choose from IBKR or Oanda App to start forex trading. Both platforms offer android and iPhone mobile trading apps. Interactive Brokers stands out by providing symbol syncing across its app and web platforms. You can explore 97 technical studies and advanced charting features. OANDA Forex apps provide an auto-saving chart drawings feature. Check out some of the mobile app trade features:

| Feature | IBKR | OANDA |

| Watch list Syncing | Yes | No |

| Mobile Charting – Indicators / Studies | 97 | 30 |

| Mobile Charting – Draw Trend lines | Yes | Yes |

| Mobile Charting – Multiple Time Frames | Yes | Yes |

| Mobile Charting – Drawings Auto save | No | Yes |

You can choose the platform that matches your trade style and strategy. Both platforms provide essential features such as price alerts and trend line drawing. Surely, compare both broker’s forex trading apps for beginners.

Trading Instruments

Execute unique instruments in your trade journey with Oanda and IBKR. Both exchanges allow diversification of your portfolio, providing different assets with variable spreads and commissions. Oanda’s platform supports 120+ trading assets including cryptocurrencies, CFD’s, forex and other commodities for active chart monitoring. Traders using MT4 can integrate live and demo accounts to access advanced trading tools and instruments. IBKR day trading supports 30,000+ instruments consisting of bonds, ETF, currency, stocks and futures. Access variable spreads and advance charting tools on TWS platform. Indeed, consider parameters such as charting systems, spreads, and instruments to choose a reliable broker.

Best For Beginner Trader

Choose the best broker for beginner traders. IB is a top platform for beginner traders to start their investment journey. You can leverage the free Traders’ Academy’s wide range of educational resources. The courses will help you establish a solid understanding of how to use advanced tools and indicators. You can trade in assets such as stocks, options, futures, and forex. Further, you can execute APIs and automated algos with Oanda’s brokerage accounts.

Oanda is another good option for beginner traders. They have a more comprehensive site compared to IBKR. You can start your journey with low minimum deposits of $1. Plus, you can learn to trade using their free demo account. One drawback is that they provide fewer learning resources. Surely, compare both platforms before getting started with Interactive Brokers Forex trading.

Account Types

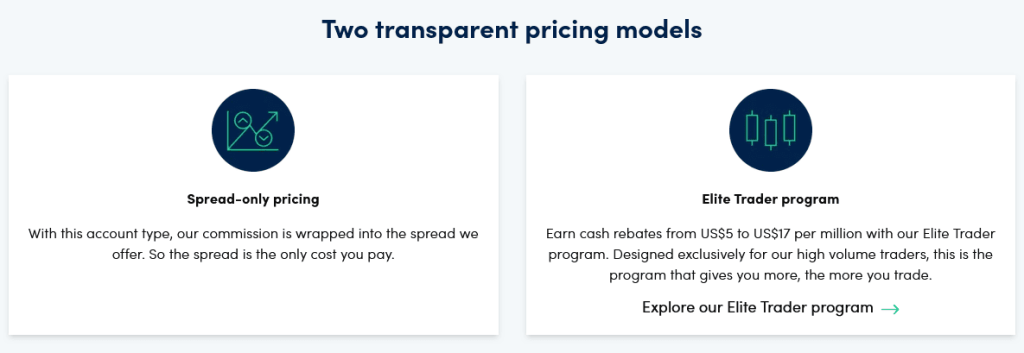

Global traders can leverage standard and diverse account types offered by both market exchanges. You can become multi-account manager with Oanda to run business and proprietary trade accounts. Open a swap-free account to trade actively with low commissions and charges. Traders with volume above 10M can open an Elite Trader Loyalty account and get a dedicated relationship manager support.

IB’s percentage allocation money management account can support investors and traders for long-term planning. You also get 10+ account types including MAM, Swap free account, and Islamic account. Families and entrepreneurs can leverage tailored account types such as proprietary group accounts.

OA’s and IB’s trading platforms follow shia laws to provide tailored Islamic accounts type. Both exchanges cater to traders and investors around the globe offering unique account types and trade instruments. Open a demo account with a broker of your choice before proceeding with long-term investments.

Promotions Offers

Leverage welcome bonus and referrals offered under the trading platform of the firm. Oanda offers welcome bonus specific to new forex account opening. The offer reaches up to $10,000 on a deposit of $50,000. Unlock the welcome bonus by trading a national volume of $50,000,000 on your live brokerage account. Whereas, IBKR members receive a fixed amount of $200 on each new referral. The referred person is required to make a $10,000 deposit for the referrer to receive $200. The deposit needs to be made within 30 days of account opening, with the ability to maintain a balance for a year. A new referrer can earn up to $1000 with a 1% bonus on each deposit. Both promotions are available only on new accounts with either of the companies. Traders can leverage offers considering their position and journey with each firm.

Customer Support

Understand IBKR and OANDA’S customer support level for traders. OANDA is highly recognized for their user-friendly customer support teams. They provide a straightforward account setup process and offer responsive customer support. Their interface also makes the buying and selling process for beginner traders less intimidating. Moreover, this company actively provides comprehensive educational content and advanced market analysis tools. Of course, this makes it an ideal platform for beginner traders.

IBKR maintains strong customer service and reliable mobile investment apps with constant improvements. However, this automated trading platform may have a steep learning curve for new users. Retail traders seeking a simpler and immediate journey may find their platform difficult to follow. Definitely, Interactive Brokers’ services are ideal for experienced traders who are familiar with trade mechanics and terminology.

Definitely compare their customer support feaures before you start your financial journey.

Trading Conditions

Check out Interactive Brokers and Oanda trading conditions. Both platforms mostly share common conditions for traders. Beginner traders can choose any of these platforms based on there market preference. The trade fees of IBKR are similar to Oanda’s. Review the market conditions offered by both platforms:

| Feature | OANDA | IBKR |

| Trade conditions | Beginners, commission, floating/low/tight/zero spread, autotrade, copy trade, expert advisor, hedging, scalping | Beginners, commission, fixed/floating/low/tight spread, expert advisor, hedging, scalping |

| Minimum deposit | No minimum deposit | $0 |

| Charting platforms | MT4, Internal Platform, TradingView | IB Trader Workstation, IBKR GlobalTrader, Client Portal |

| Max Futures leverage | 1:50 | 1:50 |

| Supported markets | Forex, Indexes, Commodities, Metals, Bonds, Crypto | Stocks, Forex, ETFs, Mutual Funds, Bonds, Options, Futures, Crypto, Hedge Funds |

| Financial assets | 120+ | 30,000+ |

| Account types | Standard, Core, Swap-free | Cash account, Margin account |

| Base currencies | USD, EUR, HKD, SGD | USD, EUR, GBP, AUD, CAD, CZK, DKK, HKD, HUF, ILS, JPY, MXN, NZD, NOK, PLN, SGD, SEK, CHF, CNH |

The Interactive Brokers algo trading software offers an advanced tools and routing that allows API trading. Experienced traders can leverage this in their algorithmic strategy. Surely, review both the platform trade conditions before creating your account.

Leverage

Both brokers provide trading leverage to amplify your market positions. The margin ratio shifts based off the account type, trade asset, and regulation authority. Interactive Brokers allow traders from the US to benefit the 50:1 leverage under forex assets. Traders from United Kingdom and Australia are provided with a leverage of 30:1 and 200:1, respectively. European’s are offered a standard leverage of 30:1 for FX trading.

Oanda offers a 50:1 margin for traders having an American trade account. The leverage on these accounts is identical to IB’s margin. This brokerage firm offers 30:1 ratio for the UK and Europe, whereas, Australian traders with small accounts can utilize a high leverage of 400:1 to quickly enhance their market budget. Indeed, support your market positions with using brokers with high leverage to earn substantial profits.

Mobile Trading and User Experience

Both platforms have efficient mobile trading solutions, though their user experiences differ. IBKR mobile is feature-rich and mirrors the advanced facilities of its desktop version. The app has unrestricted access to all asset types, providing algorithmic options, access to live market data, and advanced charting tools. While highly functional, starter traders may find the mobile app overwhelming and complex. For professional traders, IBKR mobile is highly recommended for its expert functions, and is tailor-made to manage multi-asset portfolios remotely.

On the other hand, Oanda’s mobile application is simplicity-focused. Traders can access their accounts, manage positions, and execute trades easily. The app also includes live price alerts, full access to complete selection of tradable assets, and customizable charts. Definitely, the firm’s mobile app is a reliable option for traders looking for a smooth financial journey.

Review both brokers’ mobile applications and choose your preferred broker.

Cryptocurrency Trading

Trade popular cryptocurrency coins under the Oanda and IBKR’s crypto trading platform. Oanda offers BTC and Ethereum trading on it’s low commission and OANDA minimum deposit account. The brokerage firm also provides an all-in-one trade platform for executing trades among multiple crypto assets. Moreover, you can trade bitcoin and bitcoin cash with a commission of just 0.25% on the trade value. Cryptocurrency traders can execute orders among Ethereum, PAX gold, chain-link and lite coin against the American dollar.

IBKR traders are offers a low commission of 0.12% to 0.18% per trade with zero spreads and markup costs. You can leverage 0$ commission on the Exchange Trade Products(ETPs) and execute market orders on futures and options with a per contract charges, ranging between 0.25 to 0.85 US dollar. You can hold and place trades on crypto assets such as Ripple, Doge coin, BTC and many more. In fact, if you’re looking for no PDT broker, you might consider trading crypto. Profitable traders can withdraw earned crypto to a third-party wallet using Paxo or Zero Hash IBKR account. Indeed, daytrading with Interactive Brokers offers crypto trades at a low commission.

Investment Programs

Compare investment programs offered by IBKR and Oanda. Both platforms offer unique investment plans designed for traders with varying preferences. Interactive Brokers emphasizes on long term investment choices such as hedge funds, bonds and automated portfolios. Additionally, if you’re looking for passive income via money management, IBKR is your top choice. However, note that the platform does not support trade duplication, MAM/PAMM and managed accounts.

Oanda offers access advanced copytrading for traders who want to follow experienced traders. This is particularly ideal for traders keen on forex trade copying and quick execution of their trades. Certainly, consider your preference between a diversified approach and automated strategies, and pick the desired investment programs.

First, consider low spread forex pairs and fees to choose a brokerage that meets your investment budget. Next, consider withdrawal and deposit requirements for each platform. Of course, both Brokerage firms also offer unique features like charting and analysis tools. In addition, compare mobile and web platforms to find a brokerage that meets your accessibility needs. Furthermore, look for a trustworthy, well-regulated broker to minimize your risk. Consider the points above for a detailed comparison of AvaTrade vs Interactive Brokers vs Oanda.